Bank loans and overdrafts. These would be your monthly.

Here is a list of items commonly found in the liabilities section of the balance sheets of companies.

. Examples of Long-term Liabilities Other long-term liabilities are debts due beyond one year that are not deemed significant enough to warrant individual identification on a. They generally extend past 12 months with current liabilities due within 12. For non-current liabilities long.

A long-term liability also known as a non-current liability is an obligation that is outstanding but not due within the current operating cycle. Examples of Noncurrent Liabilities. This section includes accounts such as loans debentures deferred income tax and bonds payable.

The current liability current portion of long-term debt will report 40000. Mortgages car payments or other loans. Long-term debt-to-assets ratios only take into consideration a companys long-term liabilities whereas the total debt-to-assets ratio includes any debt that the company has.

Long-term liabilities are obligations that a company must settle after a year. Examples of Long-Term Liabilities. Total liabilities Long-Term Liabilities Current Liabilities.

In addition the specific long-term liability accounts are listed on the balance sheet in order of liquidity. Big corporations have different kinds of long-term liabilities than small businesses. The market rate of.

If youre looking to invest in a major corporation its. Consider for example that Marie Co. Long-term liabilities are the sum of all the money owed to other persons by a business over a longer period.

Noncurrent liabilities include debentures long-term loans bonds payable deferred tax liabilities long-term. This stands in contrast versus Short-Term. Long-term Liabilities Definition Examples.

For most businesses this is 12 months. A liability is a responsibility or a promise to another person or entity. There are various reasons why companies prefer long-term liabilities as compared to the.

Long-Term Liabilities are obligations that do not require cash payments within 12 months from the date of the Balance Sheet. This is the principal payment due within one year of December 31 2022 the payment due on December 31 2023. Non-current liabilities are the.

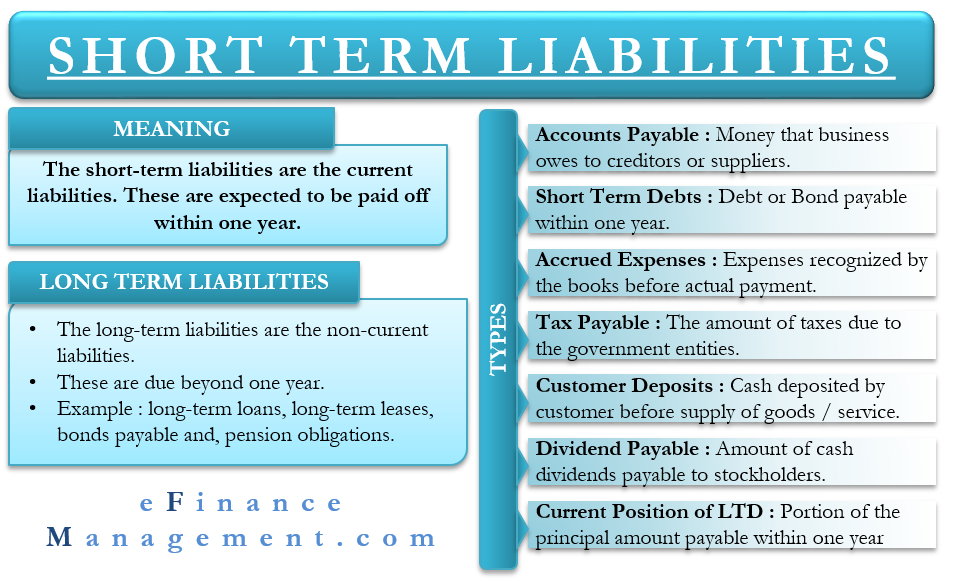

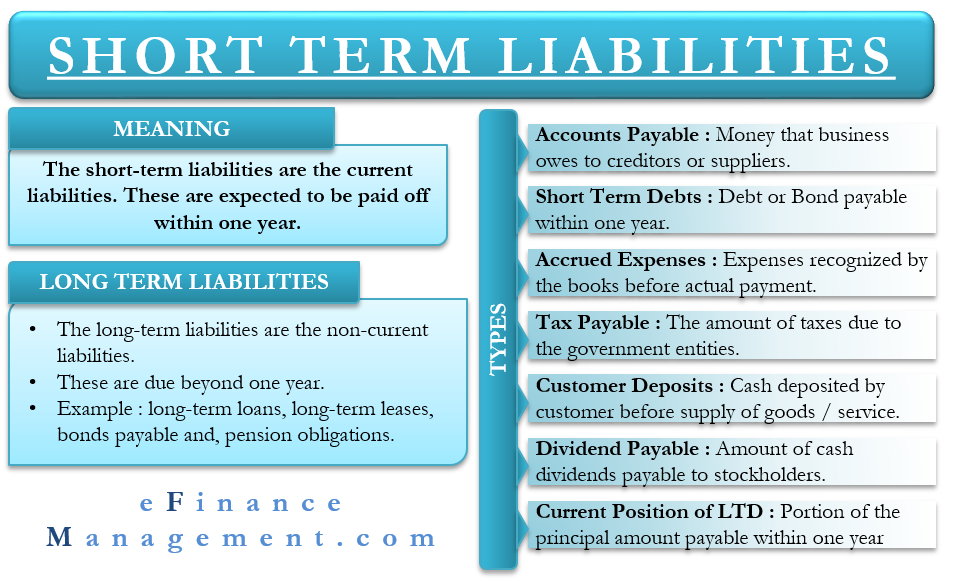

Therefore an account due within eighteen months would be listed before an account. The long-term liabilities that should be settled within one cycle of the companys operations or within a year fall under short-term liabilities. To resolve financial issues many companies use internal and third-party funding sources.

Issued for cash a 10000 three-year note bearing interest at 10 percent to Morgan Corp. Which is not long-term liabilities. Examples of the current liabilities are accounts payable short-term debts notes payable advances received from customers etc.

Examples of Long-Term Liabilities Deferred tax liabilities typically extend to future tax years in which case they are considered a long-term liability.

Short Term Liabilities I Meaning And Types Efinancemanagement

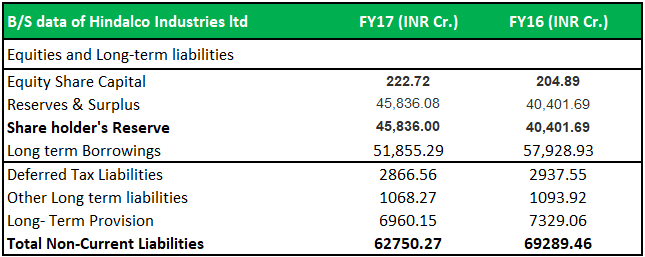

What Are Long Term Liabilities Bdc Ca

:max_bytes(150000):strip_icc()/ScreenShot2021-08-21at5.02.29PM-f5d77e3185ff4122a026ba2a6c89c6de.png)

0 Comments